By Trevor Troyer, Agricultural Risk Management

I have been getting asked, “How does the One Big Beautiful Bill Act affect my crop insurance?” Does it make any changes to grape crop insurance? Will it lower my premium or increase my premium?

Lawmakers passed the One Big Beautiful Bill Act (OBBBA) on July 4, 2025. There were several changes made to the Federal Crop Insurance Act that affect growers, and the OBBBA made several improvements to crop insurance programs. Crop Insurance is a valuable tool that is used to mitigate risk and is an essential safety net for many producers. It also included updates and increased coverage options and, in some cases, higher premium support. Below I have summarized some of these to help you understand how you may be impacted in the next year.

One of the most significant changes that was made was expanding the benefits for Beginning Farmer or Rancher (BFR). In the past if you qualified as a Beginning Farmer or Rancher you would receive an additional premium subsidy of 10 percentage points greater for the coverage level you had chosen. In addition to the extra premium subsidy all administrative fees would be waived. You would also receive an increased percentage of any transitional yields from 60% to 80%. This means when you have a low yield that triggered the Yield Adjustment (YA) endorsement in your production database, you would be able to substitute a higher percentage. BFR benefits in the past lasted for 5 years. With the passing of the OBBBA these benefits are now expanded to 10 years. In addition to the 10% premium subsidy rate a BFR will receive an additional 5% premium subsidy for the first two crop years. Then a 3% premium subsidy rate increase for the third year and an additional 1% for the fourth year. These BFR changes will increase premium support and allow more growers to qualify for this benefit, and for a longer period.

The One Big Beautiful Bill Act also amended Area Based Crop Insurance Coverage and Supplemental Coverage Option. I won’t get into all of these because some are not applicable to grape crop insurance. One that does interest a lot of vineyard owners is Fire Insurance Protection Smoke Index or the FIP-SI endorsement. The premium subsidy for this has gone from 65% to 80%. This may make it an interesting option for those in areas where fires can cause significant smoke taint damage.

Here is what it says in the USDA Risk Management Agency’s Fire Insurance Protection – Smoke Index Fact Sheet – “The Fired Insurance Protection-Smoke Index (FIP-SI) Endorsement covers a portion of the deductible of the Grape Crop Provisions when the insured county experiences a minimum number of Smoke Events as determined by the Federal Crop Insurance Corporation (FCIC) in accordance with the Smoke Index Data Provisions (SIDP) and identified in the actuarial documents.”

This endorsement is based on your underlying policy’s guarantee. In other words, the prices per ton and the average tons used for the underlying policy and your coverage level. You can never cover 100% of your average production with crop insurance. You can only cover up to 95%, even though a policy may not have that high coverage. Grape crop insurance only goes to 85%, and this is done with optional endorsements etc. FIP-SI covers the deductible portion up to 95%. If you had 50% coverage on your grapes it would cover 45% of your deductible. If you had 75% coverage the FIP-SI endorsement would cover 20%, etc.

You sign up for Fire Insurance Protection – Smoke Index by January 31st. This is the Sales Closing Date for Grape Crop Insurance in California. The insurance period for FIP-SI begins on June 1st and ends on November 10th. You do not need to report your acres separately as it uses the underlying policies acres.

Here is the Cause of Loss from the 26-FIP-SI Endorsement:

Causes of Loss

(a) This Endorsement provides protection for Smoke Events that meet the County Loss Trigger when the minimum number of Smoke Events occur in the county as identified in the actuarial documents. Triggered counties will be determined after the end of the Insurance Period.

(b) Individual vineyard yields are not considered under this Endorsement. It is possible that your individual vineyard may experience reduced yield(s) and you do not receive an indemnity under this Endorsement.

(c) The notice provisions in section 14(b) of the Basic Provisions do not apply to this Endorsement.

(d) Once published, FCIC’s determination in section 8(a) is final and is a matter of general applicability, presumed to be accurate, and will not be changed.

So, you may not have any Fire or Smoke damage to your vineyard or grapes but still receive a payment. This is based on your County. No adjuster is required for this. You are not required to file a Notice of Loss with your crop insurance agent. Or you may have a loss and get a claim payment for your grape crop insurance and for FIP-SI as well.

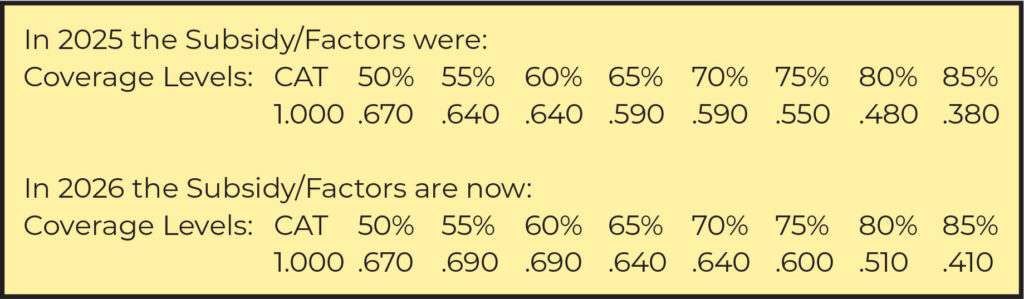

Another major change that comes out from the OBBBA, that will make difference to a grower’s premium, is an increased subsidy rate.

An increase in the subsidy portion of the premium will decrease the Producer Premium for that same level. It also opens the door for some to increase coverage as they will be receiving more support. A higher coverage level means that you have more of a chance of having a claim paid.

With grape crop insurance you are covering an average of your historical production per variety. Coverage levels go from 50% to 85%. You have a built-in production deductible with your coverage. If you choose 70% coverage you have a 30% deductible. You would have to have a loss of over 30% to have a payable claim. So, if you had a loss of 40% of your average production you would get paid on the 10% past your deductible.

With an increased subsidy it might make sense for some to move up another 5% or more in coverage.

As an example, I ran a quote for 10 acres of Chardonnay in Sonoma County in California. The set price per ton is $2401. I used an average of 4 tons per acre for the quote. So, at 70% your guarantee would be 2.8 tons per acre. If you harvest under that you would have a payable claim. The 2025 premium per acre was $119, for the 10 acres $1190. For 2026 the premium per acre is $99.70 and then for 10 acres $997. As you can see this does make a difference. Whether or not you decide to move up in coverage, saving money while mitigating risk is always important.

USDA Risk Management Agency Administrator Pat Swanson said. “We’ve moved quickly to put American farmers first, ensuring they have the protection they need when unavoidable natural disasters occur. We encourage all producers to work with their crop insurance agent to understand how these historic changes will benefit their operations.”