Five reasons why mobile retail works for wineries

By Corey Krejcik, Founder of Thirsty Bandit

In today’s marketplace, wineries are discovering that fixed tasting rooms, while foundational, are no longer enough to fully capture consumer attention or revenue potential. The modern wine audience is constantly in motion, more often exploring experiences that fit into their lives rather than planning entire weekends around a single visit. As a result, mobile retail (think branded trailers, trucks, or small pop-up tasting experiences) and seasonal activations have become essential tools for growth, storytelling, and brand connection.

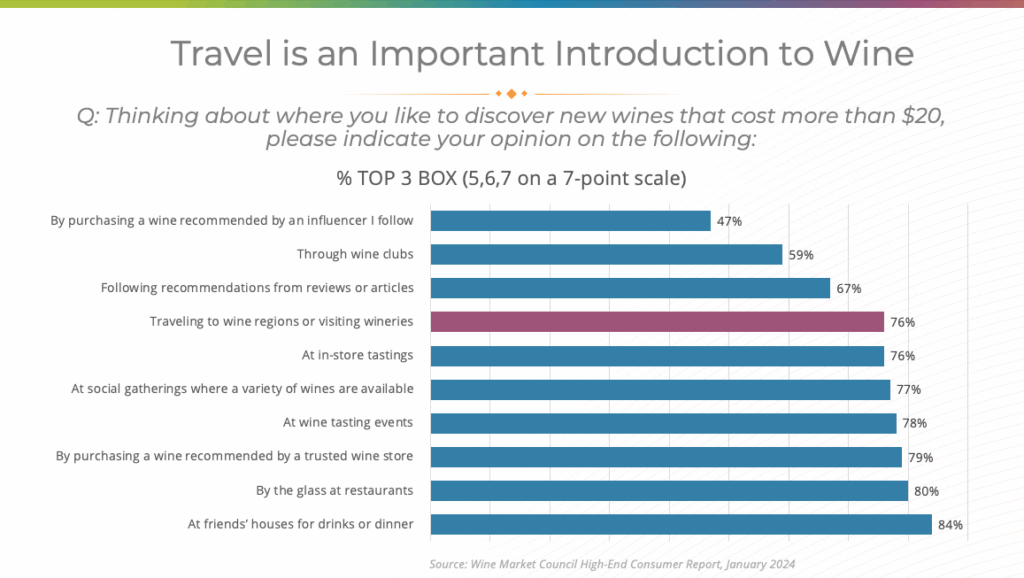

According to Wine Market Council research, nearly 60% of millennial wine buyers say they’re more likely to try a brand if they encounter it at a festival, pop-up, or event. These mobile formats are rewriting the rules of engagement: reaching new customers, building awareness, and generating direct sales—all with lower overhead and faster returns than permanent infrastructure ever could.

Below are five interconnected reasons why this model works and why wineries that embrace it early are likely to lead the next era of growth.

1. Brand Visibility as a Moving Billboard – Every mile a mobile wine unit travels is a marketing impression. A well-designed trailer or branded truck isn’t just a point of sale; it’s a rolling expression of your brand identity. Wrapped in bold visuals, anchored by consistent design language, and styled with the same intentionality as a tasting room, it becomes a moving billboard that tells your story everywhere it goes.

Imagine a well-designed wine trailer parked along Main Street for a downtown First Friday program. Staff chatting up customers and pouring glasses to be enjoyed while shopping after-hours. Passersby stop, take photos, and post them online. The moment isn’t just aesthetic; it’s strategic. Every shared image, every tagged post, extends your reach far beyond the event itself.

Smart design makes this amplification effortless. “Instagrammable” touches like a striking bar façade, a photo wall, or a vintage-inspired logo, encourage organic sharing. QR codes linked to wine clubs or digital tasting notes turn social impressions into measurable leads. The exposure doesn’t end when the event closes, it multiplies across feeds, hashtags, and memories.

In a category that often leans on tradition, mobility signals modernity. It tells consumers your brand isn’t confined to the vineyard—it’s part of their lifestyle, wherever they go.

2. Lower Fixed Costs & Faster ROI – Every winery leader understands the cost of brick and mortar: design, construction, utilities, maintenance, and staffing. A mobile unit rewrites that equation.

Compared to building or leasing a permanent tasting room, mobile activations dramatically reduce fixed costs. There’s no need for heavy infrastructure, zoning approvals, or long-term leases. Most mobile setups are built as plug-and-play systems. Units are meant to be self-contained, code-compliant, and designed to be operational in minutes.

But the most compelling case isn’t just lower cost, it’s speed of return. For many wineries, mobile units pay themselves back within a single season of festivals, markets, or regional events. A well-run activation can pour thousands of glasses over a few weekends, with direct sales, signups, and wholesale leads all feeding the revenue stream.

From a strategic perspective, mobile retail functions as both a sales tool and a marketing engine. The investment is easy to justify when the same asset generates immediate income, long-term exposure, and scalable brand equity.

Even accounting for staff, licensing, and fuel, a mobile unit often costs a fraction of a single tasting room buildout. The result: more financial flexibility and faster pathways to profit.

Corey and Rachel of Thirsty Bandit chat with Suzanne Hasz, founder of Hudson Trailer Co., about the growth potential of mobile retail and seasonal pop-up experiences for wineries, exploring how evolving consumer behaviors are driving brands to meet audiences wherever they are.

3. Flexibility & Seasonal Alignment – Wine is seasonal with production schedules, harvest, events, and consumer habits ebbing and flowing throughout the year. A mobile retail program lets wineries move with the rhythm of demand rather than being anchored to it.

Picture this: a winery launches its spring rosé release at a downtown flower festival, pours summer whites at a waterfront concert series, and then rolls out to a harvest celebration in autumn. Each stop hits a different audience, season, and mindset, but the brand remains consistent.

This flexibility doesn’t just boost revenue; it optimizes operations. Inventory can be shifted in real time to high-traffic events. Staff scheduling becomes dynamic rather than static. Marketing follows cultural energy rather than waiting for it.

In practical terms, this means your brand stays top-of-mind year-round, not just during wine country’s peak tourism months. And for smaller wineries, mobility provides the agility to compete in larger markets without the overhead of permanent expansion.

4. Experiential Appeal & Consumer Expectations –

Modern consumers want more than a transaction. They crave connection, storytelling, and experiences that feel personal. The tasting room will always be sacred, but it represents just one chapter in the customer journey.

Mobile activations give wineries a way to bring the vineyard to the people. When executed thoughtfully, each encounter becomes a chance to tell your story: how your grapes are grown, what inspires your blends, why your brand exists at all. Guests aren’t just sampling—they’re connecting.

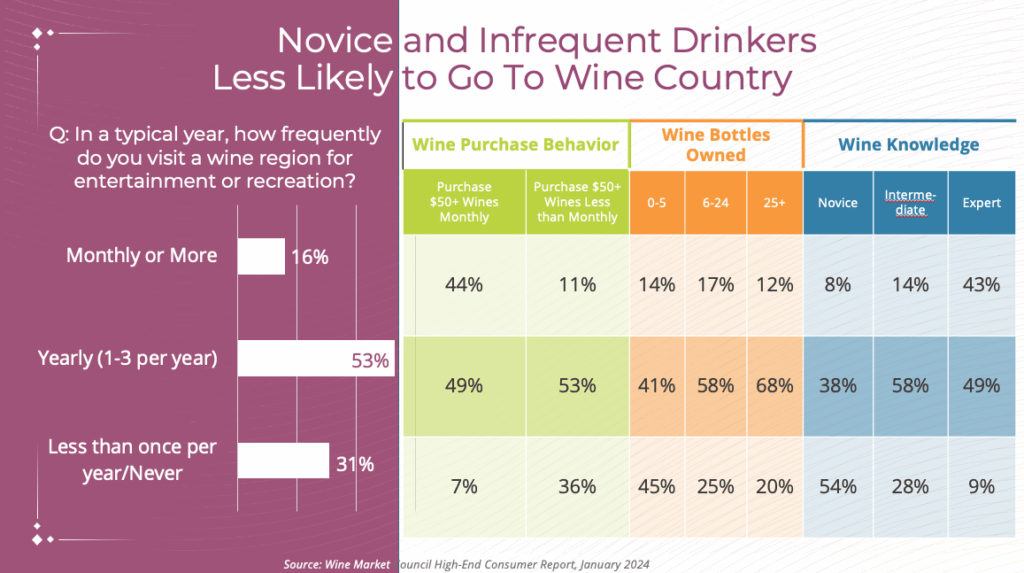

In many cases, a single memorable experience can shift perception more effectively than any ad campaign. Someone who discovers your brand at a festival might later seek out your bottles at retail, join your wine club, or even plan a trip to the vineyard itself.

Experiential retail isn’t a trend; it’s a reflection of how modern consumers form loyalty. They don’t just buy what you make, they buy how you make them feel.

5. Testing New Markets & Expanding Reach –

Perhaps the greatest strategic advantage of mobile retail is market testing without permanent risk.

For rural or destination-based wineries, reaching new audiences can be costly and uncertain. A mobile unit allows them to meet urban consumers where they already gather—farmers markets, concerts, street fairs, or high-end shopping districts—without committing to a long-term lease or a new facility.

These interactions go beyond direct sales. Every event provides insight into customer behavior, pricing sensitivity, and brand perception. Tracking purchases, email captures, and on-site engagement builds a feedback loop that informs broader strategy.

Imagine a mid-sized winery that takes its mobile tasting bar on a six-city summer circuit. Over three months, it collects thousands of emails, identifies which markets drive the most engagement, and discovers that its rosé outsells reds by 2:1 in coastal regions. Those insights shape next year’s production and marketing plans.

Each glass poured becomes a data point, each conversation a potential customer, and each market test a map for future expansion.

Operational Considerations

Success in mobile retail depends as much on execution as vision. The logistics may be lighter than a full-scale facility, but they’re no less important.

Staff must be brand ambassadors first, servers second. They work in confined spaces, under variable weather, and in dynamic crowd conditions. This requires adaptability, strong product knowledge, and high service and hospitality acumen. Their demeanor shapes not just the immediate experience but the long-term impression of the winery.

Compliance is equally critical. Permits, health codes, and insurance requirements vary by jurisdiction, and alcohol laws can differ dramatically from county to county. A mobile unit can’t hit the road and start serving anywhere. For many wineries, partnering with local event coordinators or compliance consultants streamlines the process and ensures consistency.

Financial Clarity

For wineries weighing the investment, the economics are compelling. Mobile units typically cost a small fraction of constructing a new tasting room, and the speed of return is striking. Many recoup their investment within a single season of strategic activations.

The key is to view the build not as an expense, but as an asset with multiple revenue functions. It sells wine directly, generates brand visibility daily, and produces marketing content that drives ongoing engagement. Each event feeds both the bottom line and the brand story.

When CFOs see that a single mobile trailer can simultaneously boost DTC sales, social exposure, and wholesale leads, the case for mobility becomes more than creative, it becomes financial strategy.

Turning Tastings Into Memberships

A glass poured at a farmers’ market shouldn’t be the end of the story. It should be the beginning.

Mobile activations are prime opportunities to capture data—emails, social follows, QR sign-ups—and funnel them into your membership and subscription programs. Staff can invite guests to join wine clubs, pre-order seasonal releases, or receive exclusive offers tied to the event they attended.

This transforms a casual encounter into a relationship continuum, one that extends far beyond the moment of pour. The person who first discovered your Sauvignon Blanc at a summer concert might be receiving shipments from your reserve collection a year later.

Looking Ahead

Mobile activations aren’t a passing experiment. They’re the next evolution in how wineries engage audiences. The craft beer and ready-to-drink sectors have already proven the model, showing that consumers love brands that move with them, both literally and emotionally.

For wineries, the opportunity is to lead this transformation rather than follow it. Mobility doesn’t replace the tasting room; it extends its reach. It transforms a static space into a fluid experience that meets consumers wherever they gather.

In an industry defined by tradition, mobile retail offers something radical: the ability to be both timeless and timely. The wineries that embrace it now will not only expand their markets, but also redefine what it means to be a wine brand in motion.

Corey Krejcik is the founder of Thirsty Bandit, providing strategic marketing, brand development, and revenue optimization for hospitality and wine brands. With over 20 years of executive leadership experience, he believes the best outcomes are found at the intersection of strategy, adaptability, and identity. Outside of work, he enjoys cooking, running, home renovation projects, and spending time with his wife and two teenage children in Malvern, PA.